Impact Investing,

what is it?

Discover what is impact investing, understand the role of impact funds, see how institutional investors reach returns within the impact investing universe and access free data on impact investments.

CONTACT US

Let's talk about impact investing

If you can't find below what you are looking for, don't hesitate to ask us any questions that you may have regarding impact investing today.

Defining Impact investing - what is it?

The Global Impact Investing Network (GIIN), defines impact investing as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return”.

Whereas ESG investing looks to integrate environmental, social and governance factors when subject to an investment’s performance, impact investing goes a step further by seeking investments that contribute to measurable social and/or environmental impact.

Impact investing is addressing the world’s greatest challenges, which are summarized by the 17 Sustainable Development Goals (SDGs) and its 169 sub-goals.

Impact funds, whose goal is to implement investments that generate a measurable, beneficial social and/or environmental impact, in addition to a financial return, target one or more SDGs with their strategies.

Impact Investing is quickly spreading globally

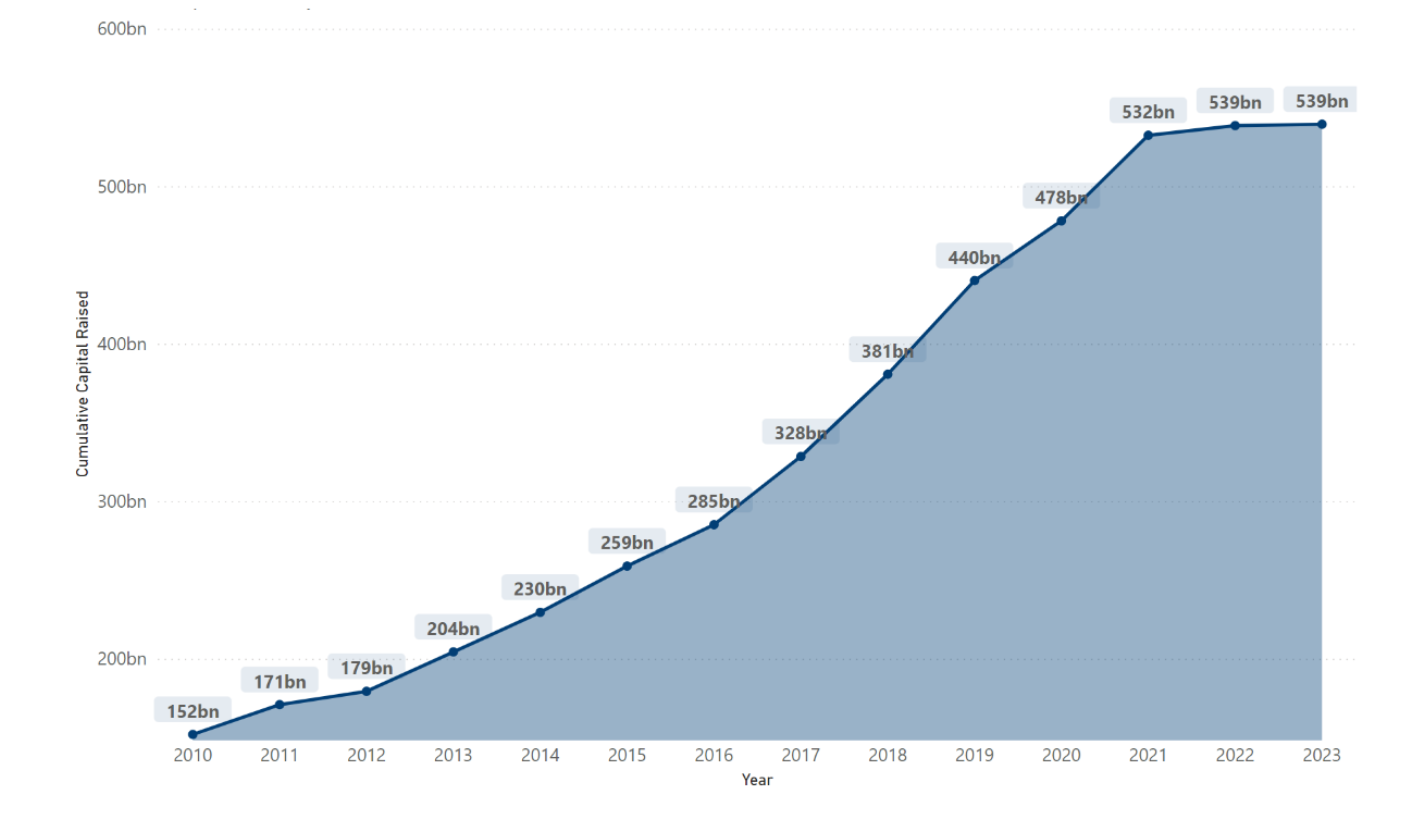

Cumulative capital raised by impact funds per year*

Investments in impact funds have been growing for more than a decade.

*Graph from our 2023 Impact Fund Universe Report.

Cumulative capital raised by asset class*

The cumulative capital raised is in excess of €600 billion, with public equity and real assets raising €180 billion each.

The most popular strategy in terms of the number of impact funds is in private equity, which has raised €156 billion cumulatively.

Private debt, which makes up 13% of the funds in the database, has raised €45 billion, while public debt has raised €33 billion.

*Graph from our 2023 Impact Fund Universe Report.

.png?width=796&height=718&name=2023%20Impact%20Fund%20Universe%20Report%20(1).png)

The characteristics of impact investments

-

Intentionality: intent to achieve a social or environmental goal is clearly expressed and the investor identifies outcomes that will be pursued.

-

Additionality: thesis or narrative describes how the investor’s actions will help achieve the goal and how the outcome would not have occurred without the investment.

-

Measurement: impact measurement framework in place to assess the level of expected impact and monitor progress against the goal.

Our Impact Fund Assessment helps institutional investors and fund managers to measure the robustness of an impact proposition with independent due diligence.

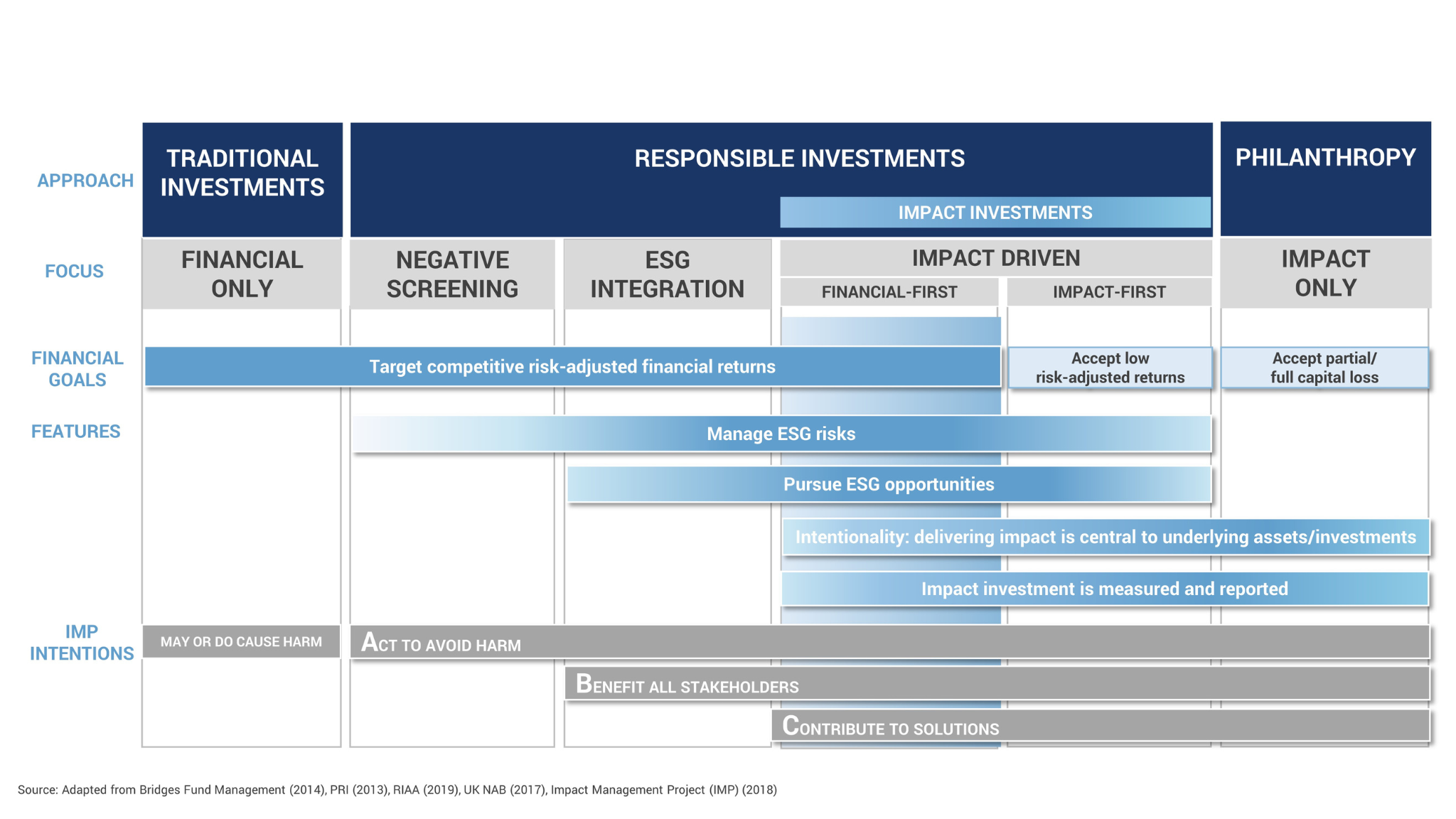

Impact investments in the spectrum of capital

First published by Bridges Fund Management (2015), the Spectrum of Capital maps out different investment approaches, depending on investors’ desired risk, return and impact profile, and categorises them in a range from traditional investment to philanthropy. Above all, there are two types:

- Financial-First Impact Investments: select funds in specific sectors, impact themes, or in alignment with the SDGs. In this approach, there is no trade-off between return and impact, and thus all investments should achieve fully commercial, risk-adjusted returns.

- Impact-First Impact Investments: funds are selected to maximize impact over returns. These investments may target lower risk-adjusted returns to deliver greater impact.

Impact funds considered in our Impact Database have an impact proposition, institutional scale, and target market-rate returns. As such, they are financial-first impact funds.

Impact investing with returns

Phenix Capital Group has a decade of experience empowering institutional investors to have a diverse and profitable investment portfolio by investing with impact. With impact and sustainable investing, institutional investors can reach impact investing returns.

We have several services to help institutional investors who would like to efficiently start investing with impact.

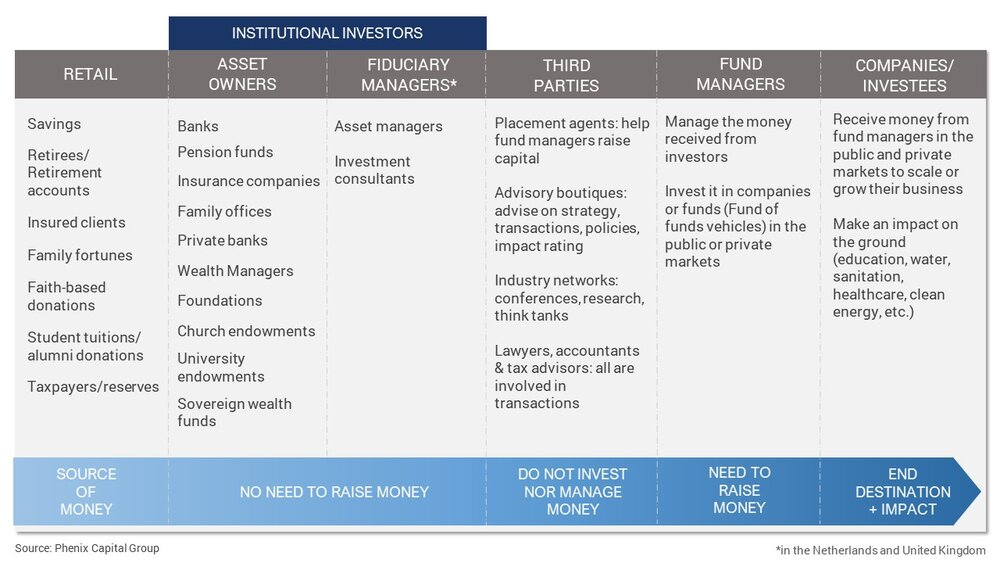

Who makes impact investments possible?

There are a series of actors who make impact investments possible. Each one of them has a different goal and challenge.

Asset owners are increasingly integrating positive environmental and societal impact into their fiduciary duty, but they still face challenges, such as:

-

Lack of opportunity

-

Liquidity

-

Execution, particularly for larger portfolios

-

Sourcing and analyzing impact managers

-

Scepticism around impact: concerns on greenwashing and measuring impact

Asset managers face challenges in finding the right balance between generating returns and integrating impact factors: intentionality, additionality, measurability, but also verifiability.

Facilitators of impact investments

Intermediaries, such as Phenix Capital Group, contribute to the spread of genuine financial-first impact investments. We are fighting impact-washing, setting industry standards, and verifying and measuring the impact of asset managers.

Phenix Capital Group has several services to help institutional investors to invest for impact and fund managers to fundraise for impact.

Besides consulting and advisory services, Phenix Capital Group also offers the most comprehensive database of impact funds, impact investing events, Impact Reports, and a knowledge hub.

Impact investing is here to stay

Institutional investors are expected to invest with impact and investing with impact is a new trend that is here to stay, but it is still not a clear process for all institutional investors around the world. Building a profitable impact investing portfolio can be a challenge.

Luckily, we started in the impact investing industry in its infant days! We are specialists who follow and report on developments.

Learn about our impact investing services for institutional investors and fund managers.